Cost Structure and Profitability Analysis of a Ferrosilicon Manufacturing Plant: A Detailed Cost Model

What is Ferrosilicon?

Ferrosilicon, an iron alloy made of silicon and iron, is a very versatile alloy that is used in many different industries, especially the steel and casting industries.

Key Applications Across Industries:

Its composition can vary, with silicon content ranging from 15% to 90%, depending on the application and desired properties. Ferrosilicon is a great ingredient for steelmaking and other industrial applications because of its high melting point and corrosion resistance. It is usually produced in different grades, such as low, medium, and high silicon, each of which has a specific function in the industries it serves.

What the Expert Says: Market Overview & Growth Drivers

According to an IMARC study, the global ferrosilicon market was valued at USD 12.5 Billion in 2024. Looking ahead, the market is expected to grow at a CAGR of approximately 2.08% from 2025 to 2033, reaching a projected value of USD 15.2 Billion by 2033.

The steel and cast-iron sectors, which utilise ferrosilicon as a deoxidising and alloying agent, are driving the global ferrosilicon market. Ferrosilicon usage is being fuelled by increased steel production, which is a result of rapid urbanisation and infrastructure development, especially in emerging economies. Another factor driving up demand is the growing use of electric arc furnaces (EAFs) in the steel industry. Further supporting market expansion is the growing usage of ferrosilicon in the manufacturing of semiconductors and silicon-based alloys. Market expansion is further supported by expanding applications in the energy, construction, and automotive industries as well as technological developments that increase production efficiency. Global investments and favourable government regulations in the metallurgical sector also serve as important growth engines.

Case Study on Cost Model of Ferrosilicon Manufacturing Plant:

Objective

One of our clients has approached us to conduct a feasibility study for establishing a mid to large-scale ferrosilicon manufacturing plant in Botswana.

IMARC Approach: Comprehensive Financial Feasibility

We have developed a detailed financial model for the plant's setup and operations. The proposed facility is designed with an annual production capacity of 6,000 tons of ferrosilicon per year.

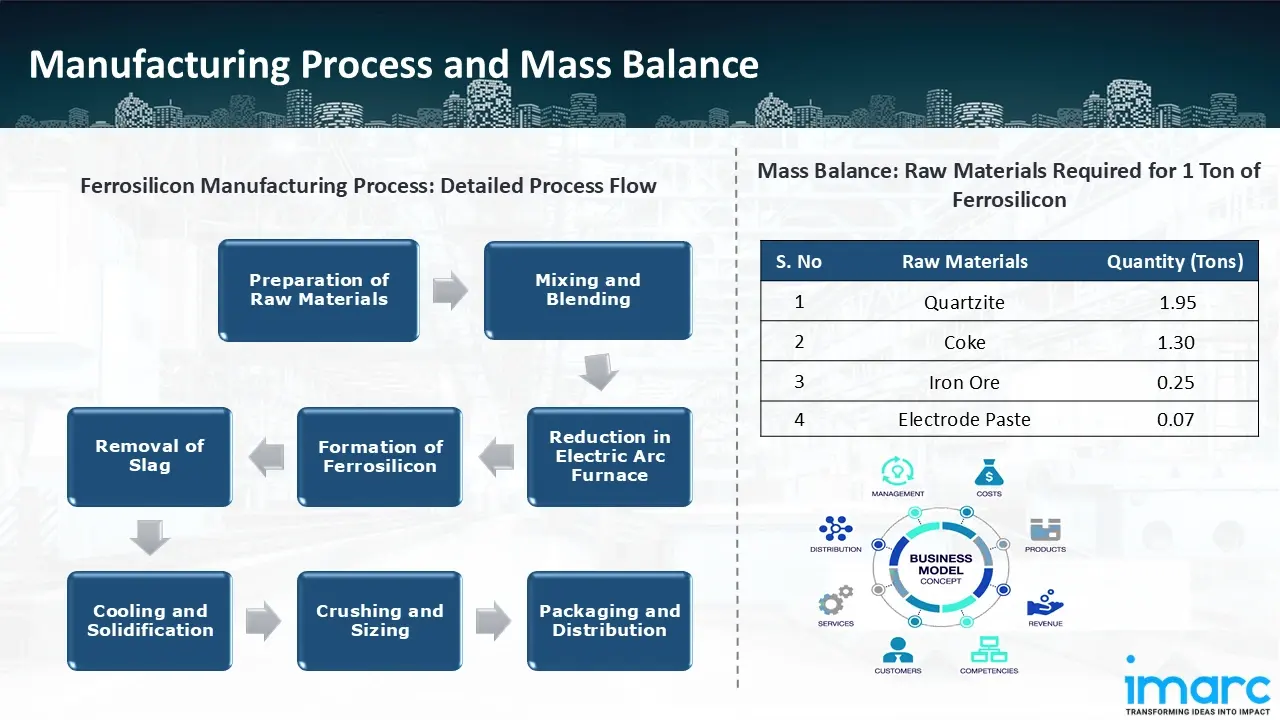

Manufacturing Process: The first step in making ferrosilicon is crushing and grinding raw materials, such as quartz and iron ore, to increase their reactivity. To get the alloy's appropriate silicon content, these ingredients are then combined and blended in exact amounts. Ferrosilicon is created when iron reacts with carbon and silicon in an electric arc furnace, where the combined material is reduced at high temperatures. Slag must be removed during the process to get rid of contaminants and guarantee the quality of the final product. After that, the molten ferrosilicon is cooled and solidified in castings or moulds. To accommodate diverse industrial applications, it is crushed and sized into varied particle sizes once it has hardened. Testing and quality control are applied to the finished product to confirm the silicon's purity and content. After packaging, it is sent to the steel and metallurgical sectors in bags or bulk containers. To handle by-products like slag in accordance with environmental rules, waste management is put into place. This efficient procedure guarantees the manufacture of high-quality ferrosilicon for use in foundries, steelmaking, and other metallurgical processes.

Get a Tailored Feasibility Report for Your Project Request Sample

Mass Balance and Raw Material Required: The primary raw materials utilized in the ferrosilicon manufacturing plant include quartzite, coke, iron ore, and electrode paste. To produce 1 ton of ferrosilicon, around 1.95 ton of quartzite, 1.30 ton of coke, 0.25 ton of iron ore, and 0.07 ton of electrode paste are required.

List of Machinery

The following equipment was required for the proposed plant:

- Material Batching System

- Furnace Sheel

- Furnace cover

- Electrode column

- Short Net

- Chimney

- Material Discharging System

- "Water cooling system in furnace"

- Hydraulic System

- Smoke exhaust

- Air injection system

- Tapping System

- Burner System

- Vertical lifting device

- Bus bar

- Ingot mould and support

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

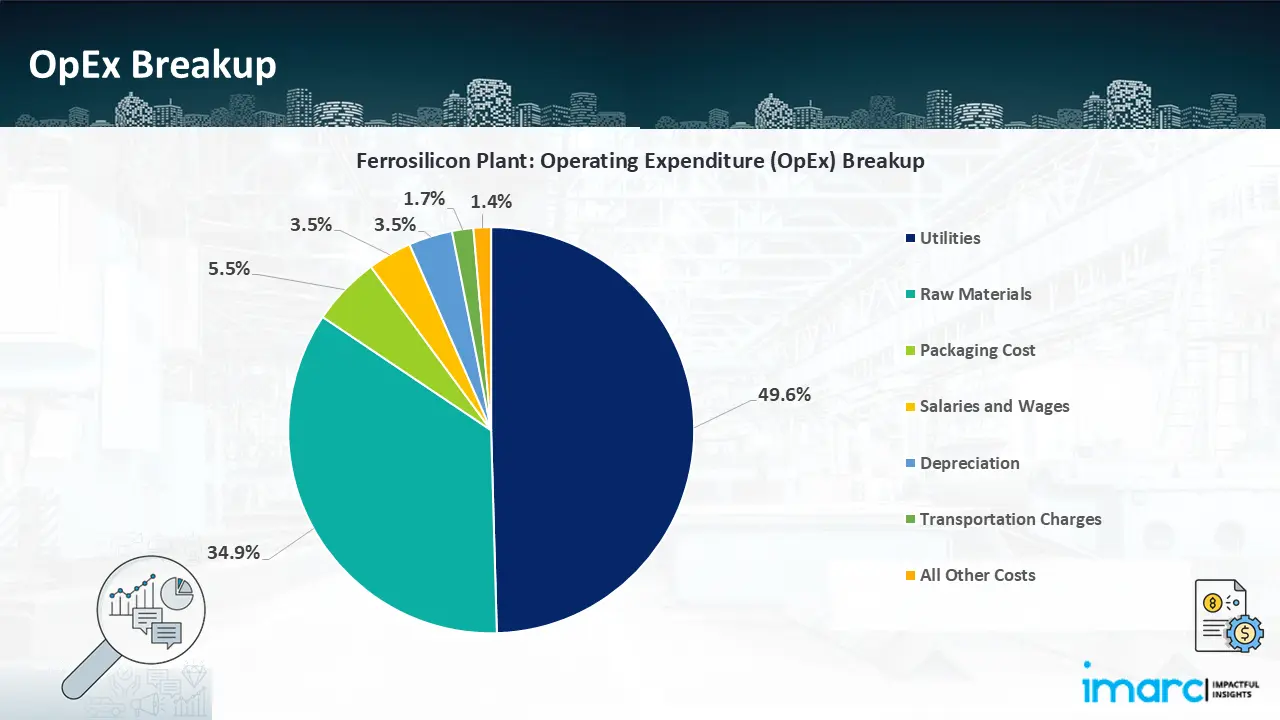

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. OpEx in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

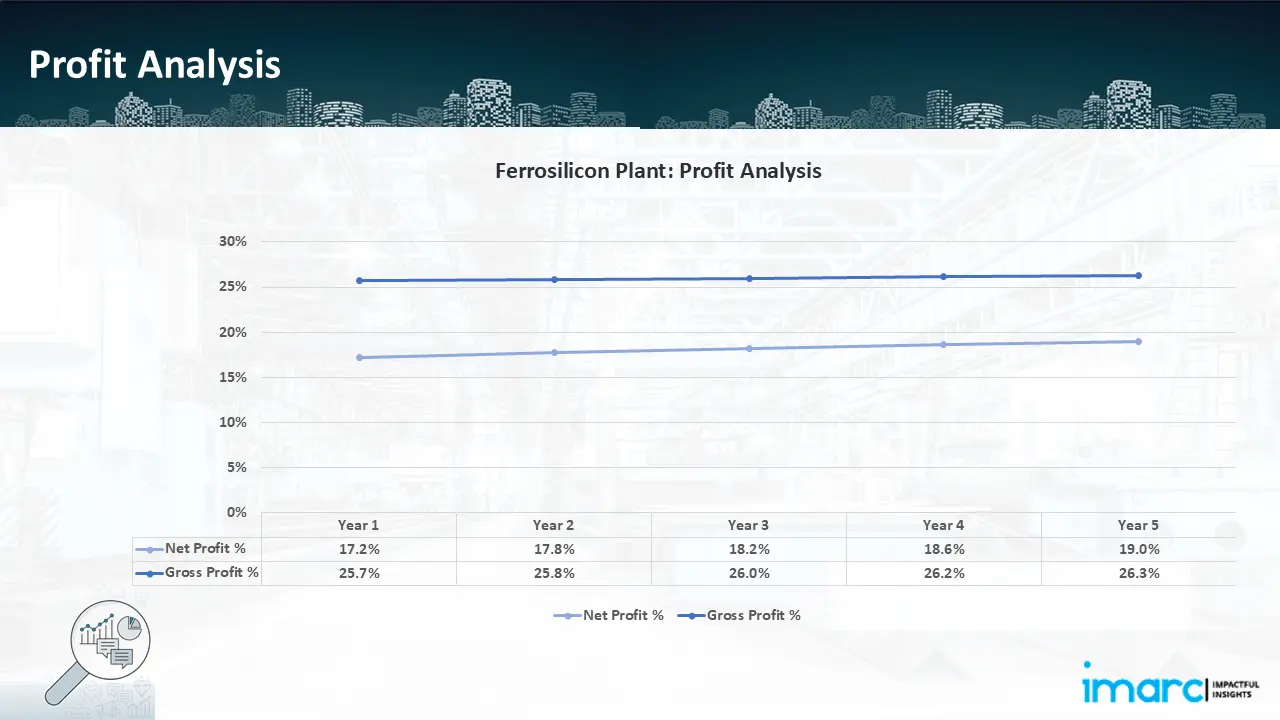

- Profitability Analysis Year on Year Basis: The proposed ferrosilicon plant, with a capacity of 6,000 tons ferrosilicon per year, achieved an impressive revenue of US$ 12.75 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit improved from 25.7% to 26.3%, and net profit rise from 17.2% to 19.0%, highlighting strong financial viability and operational efficiency.

Conclusion & IMARC's Impact:

Our ferrosilicon manufacturing plant's financial model was meticulously modelled to satisfy the client's requirements. It provided a thorough analysis of production costs including capital expenditures, manufacturing processes, raw materials, and operating costs. The model predicts profitability while accounting for market trends, inflation, and any shifts in the price of raw materials. It was created especially to satisfy the demand of producing 6,000 tonnes of ferrosilicon annually. Our commitment to offering precise, client-centered solutions that ensure the long-term success of significant industrial projects by giving the client useful data for strategic decision-making is demonstrated by this comprehensive financial model.

Latest News and Developments:

- In December 2024, the industries minister of Arunachal Pradesh, India officially opened Aether Alloys LLP, a state-of-the-art ferro silicon production facility located in the East Siang district's Industrial Growth Centre, Niglok.

- In October 2024, the United States International Trade Commission (USITC) announced that the U.S. ferrosilicon industry is materially harmed by imports of ferrosilicon from Russia, which might have an impact on trade laws and market dynamics.

- In February 2023, KeyVest Belgium S.A., a specialist in the sourcing of materials and production of ferrosilicon nitride, boron carbide, fused silica, and aluminium powder to the refractory industry and other segments including advanced ceramics, has agreed to be acquired by Elkem ASA.

- In November 2022, the Malaysian company Pertama Ferroalloys (PFA) announced increasing the production capacity of ferrosilicon for steel production by 1.7 times. Sixty thousand tonnes of ferrosilicon PFA and 150 thousand tonnes of silicomanganese are produced annually. The company intends to install two additional electric furnaces in order to increase and fortify its ferrosilicon production capacity.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Brief List of Our Services: Market Entry and Expansion

- Market Entry and Opportunity Assessment

- Competitive Intelligence and Benchmarking

- Procurement Research

- Pricing and Cost Research

- Sourcing

- Distribution Partner Identification

- Contract Manufacturer Identification

- Regulatory Approvals, and Licensing

- Factory Setup

- Factory Auditing

- Company Incorporation

- Incubation Services

- Recruitment Services

- Marketing and Sales

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104